a superannuation plan that is not a self-managed superannuation fund.

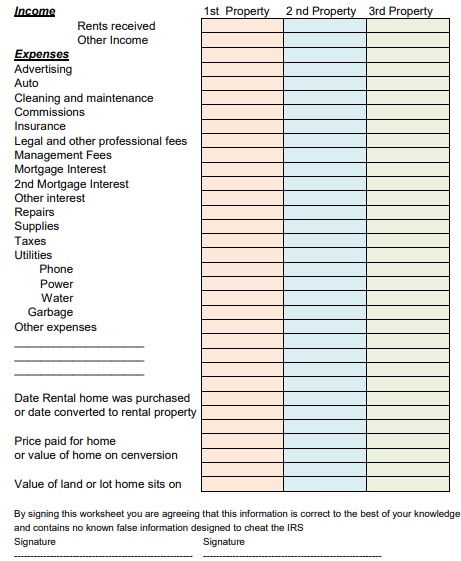

The Australian Taxation Office (ATO) considers an ‘excluded class of entity’ as: If you are an excluded class of entity or are carrying on a business for the purposes of gaining or producing assessable income, you are exempt from the new rules. visiting your agent to discuss your rental property.maintaining the property, such as cleaning and gardening, while it is rented or genuinely available for rent.undertaking repairs, where those repairs are because of damage or wear and tear incurred while renting out the property.inspecting the property during or at the end of tenancy.preparing the property for new tenants (except for the first tenants).

Rental property travel expenses that can no longer be claimed as a deduction

0 kommentar(er)

0 kommentar(er)